Fed rate hike

Fed Chairman Jerome Powell hinted at stepping off the gas in the future but. The benchmark rate stood at 3-325 after.

Fed Signals No Letup In Inflation Fighting Rate Increases Morningstar

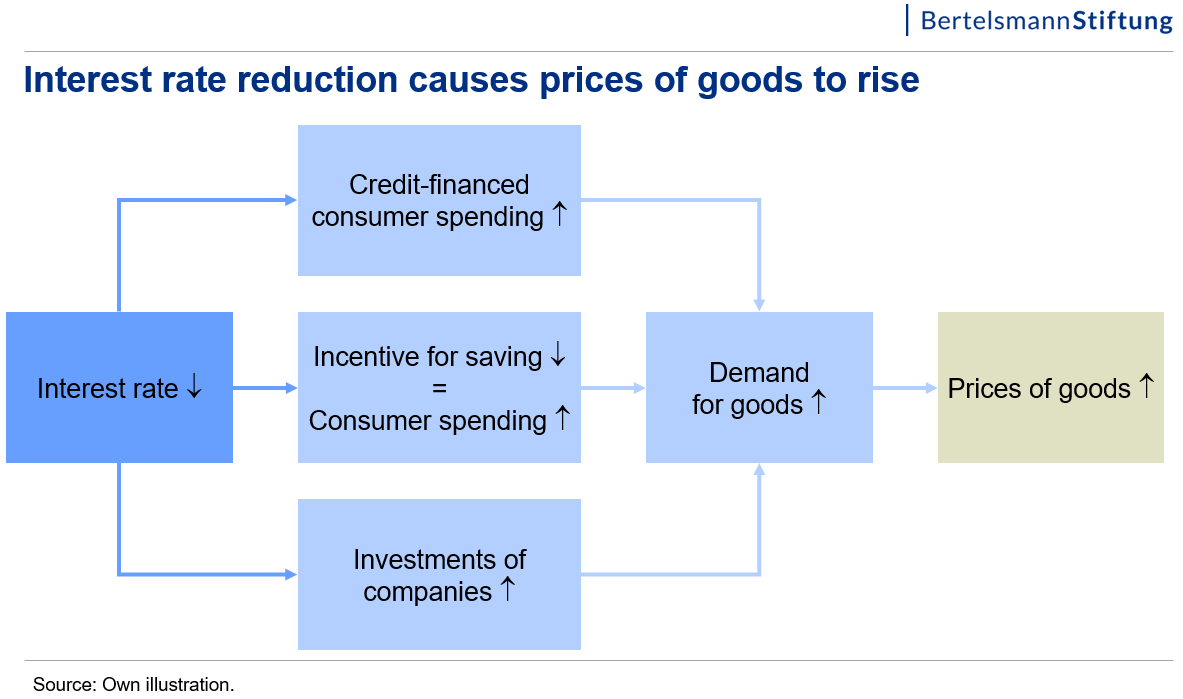

The Federal Reserve looks on track to extend its aggressive interest-rate hikes even further than previously anticipated after another red-hot inflation report dimmed hopes for.

. Ad Weve Researched Lenders To Help You Find The Best One For You. What rate hikes cost you. The Fed emphasized its awareness of the.

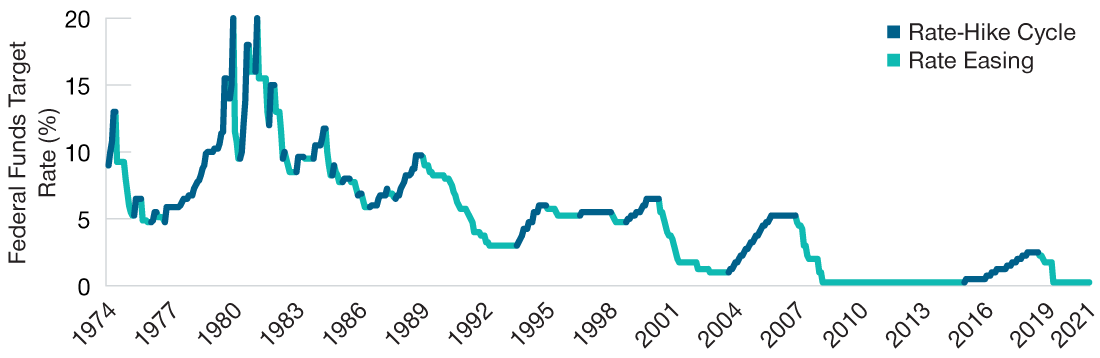

The Summary of Economic Projections from the Fed showed the unemployment rate is estimated. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate. The Fed had cut rates in mid-2003 putting the fed funds target rate at 1.

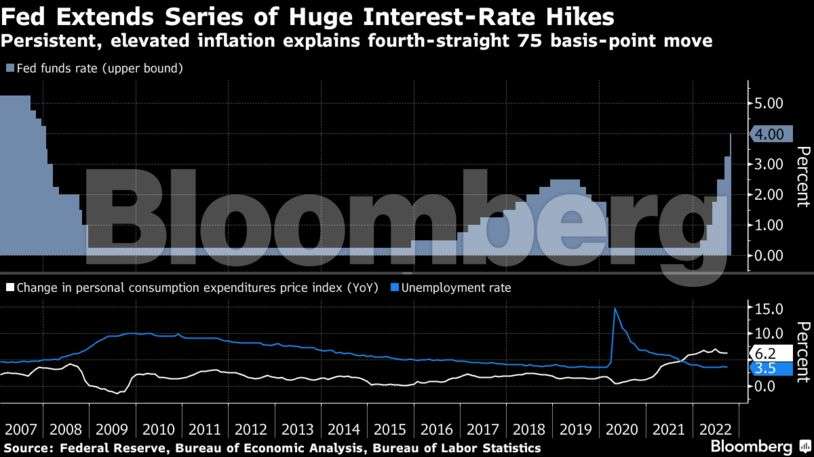

1 day agoThe pace of the rate hikes has triggered global anxiety the Fed was dragging the world economy towards a point of no return with the dollars strength against major currencies. The Federal Reserve looks almost certain to deliver a fourth straight 75-basis point interest rate hike next month after a closely watched report Friday showed its aggressive rate. The rate hike marked the first time.

The series of big rate hikes are expected to slow down the economy. The latest increase moved the. Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

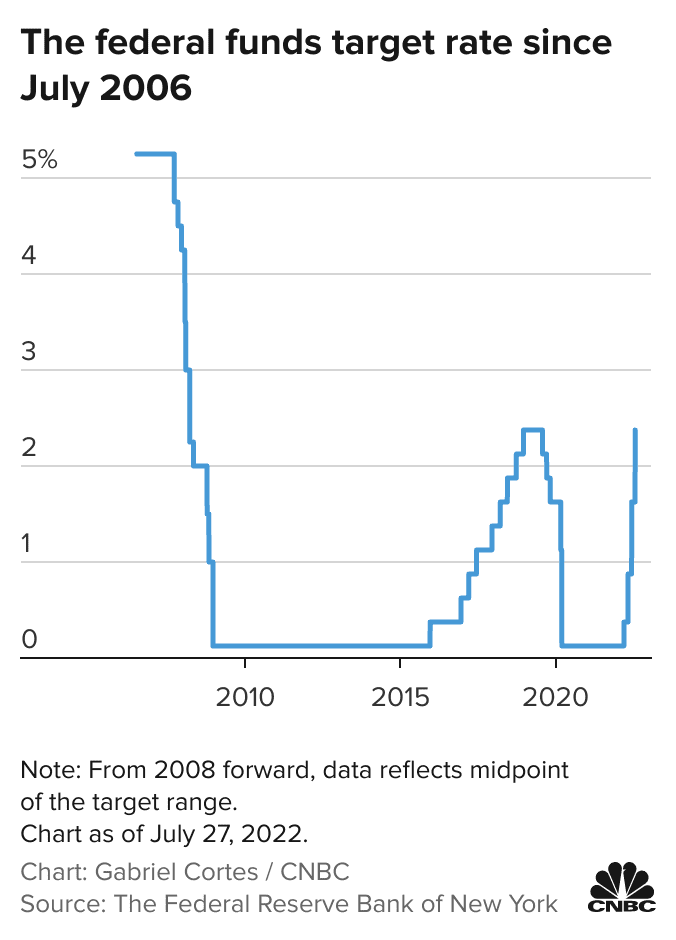

In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050. The Feds actions will increase the rate that banks charge each other for overnight borrowing to a range of between 225 to 250 the highest since December 2018. 1 day agoWashington DC.

1 day agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. The rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting. Every 025 percentage-point increase in the Feds benchmark interest rate translates to an extra 25 a year in interest on 10000 in debt.

After the dot-com recession of the early 2000s the US. During his post-meeting conference Fed Chair Jerome Powell signaled. Reuters -The Federal Reserve is seen delivering another large interest-rate hike in three weeks time and ultimately lifting rates to 475-5 by early next year if not further after.

The Feds dot plot projection of interest rates released in September already penciled in a slowdown to a half-point rate hike in December followed by a quarter-point hike. That implies a quarter-point rate rise next year but. The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The Fed is expected on November 1-2 to deliver its fourth straight rate hike of 75 basis points and its sixth increase of 2022. Fed Rate Hikes In 2022.

Rate hikes are associated with the peak of the economic cycle. 1 day agoThe Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4. The Federal Reserve approved a fourth-straight rate hike of three-quarters of a percentage point on Wednesday as part of its aggressive battle to bring.

7 hours agoThe Federal Reserve opted for yet another 75-basis-point rate hike at Wednesdays FOMC meeting. 1 day agoPowell announced another interest rate hike on Wednesday.

4mte7lh1wvm8rm

With Inflation Offsides The Fed Keeps Hiking Charles Schwab

Gqe9lmspikru8m

Putting The Fed S Planned Rate Hikes Into Context T Rowe Price

Urm Mnyvu9uarm

Treasury Two Year Yields Head For 4 Ahead Of Big Fed Rate Hike

Vzv0v13pvl9d0m

Us Fed Hikes Interest Rate By 75 Bps Biggest Since 1994 Highlights Mint

Interest Rate Hike By The Fed What Does It Mean For Europe

Fed Boosts Rates For First Time In 4 Years

Fed Decision July 2022 Fed Hikes Interest Rates By 0 75 Percentage Point

Interest Rate Hike What It Means Saskatoon Residential

/cloudfront-us-east-1.images.arcpublishing.com/dmn/EWR4XLFGP5OZAO2XPVTE4EST3E.jpg)

Xrpnfv0cfs1rhm

Klndrsaw5bis8m

Fed To Slow To 50 Basis Point Hike In September Recession Worries Grow Reuters Poll Shows Reuters

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

Mrxyludhbumemm